ConsPortfolioModel Documentation¶

[1]:

# Setup stuff

import HARK.ConsumptionSaving.ConsPortfolioModel as cpm

import HARK.ConsumptionSaving.ConsumerParameters as param

import copy

import matplotlib.pyplot as plt

import numpy as np

import warnings

warnings.filterwarnings('ignore')

from HARK.ConsumptionSaving.ConsPortfolioModel import PortfolioSolution

We implement three different ways to allow portfolio choice.

The agent can choose * any portfolio share (‘continuous choice’) * only a specified set of portfolio shares (‘discrete choice’) * With probability 1 (agent always gets to choose) * With probability 0 < p < 1 (stochastic chance to choose)

We allow two choices for the description of the distribution of the stochastic variable: 1. A generic discrete probability distribution * Nodes and their probabilities are specified 2. A true lognormal distribution * The mean return and the standard deviation are specified

In the discrete portfolio shares case, the user also must input a function that draws from the distribution in drawRiskyFunc

Other assumptions: * distributions are time constant * probability of being allowed to reoptimize is time constant * If p < 1, you must specify the PortfolioSet discretely

[2]:

# Set up the model

# Parameters from Mehra and Prescott (1985):

Avg = 1.08 # equity premium

Std = 0.20 # standard deviation of rate-of-return shocks

RiskyDstnFunc = cpm.RiskyDstnFactory(RiskyAvg=Avg, RiskyStd=Std) # Generates nodes for integration

RiskyDrawFunc = cpm.LogNormalRiskyDstnDraw(RiskyAvg=Avg, RiskyStd=Std) # Generates draws from a lognormal distribution

init_portfolio = copy.copy(param.init_idiosyncratic_shocks) # Default parameter values for inf horiz model

init_portfolio['approxRiskyDstn'] = RiskyDstnFunc

init_portfolio['drawRiskyFunc'] = RiskyDrawFunc

init_portfolio['RiskyCount'] = 2 # Number of points in the approximation; 2 points is minimum

init_portfolio['RiskyShareCount'] = 25 # How many discrete points to allow in the share approximation

init_portfolio['Rfree'] = 1.0 # Riskfree return factor is 1 (interest rate is zero)

init_portfolio['CRRA'] = 6.0 # Relative risk aversion

# Uninteresting technical parameters:

init_portfolio['aXtraMax'] = 100

init_portfolio['aXtraCount'] = 50

init_portfolio['BoroCnstArt'] = 0.0 # important for theoretical reasons

# init_portfolio['vFuncBool'] = True # We do not need value function for purposes here

init_portfolio['DiscFac'] = 0.90

# Create portfolio choice consumer type

pcct = cpm.PortfolioConsumerType(**init_portfolio)

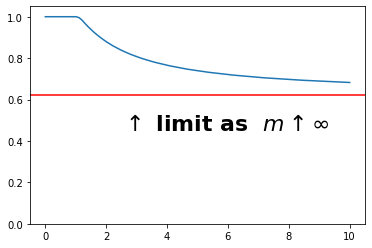

[3]:

# Solve the model under the given parameters

pcct.solve()

aMin = 0 # Minimum ratio of assets to income to plot

aMax = 10 # Maximum ratio of assets to income to plot

aPts = 100 # Number of points to plot

# Campbell-Viceira (2002) approximation to optimal portfolio share in Merton-Samuelson (1969) model

pcct.MertSamCampVicShare = pcct.RiskyShareLimitFunc(RiskyDstnFunc(init_portfolio['RiskyCount']))

eevalgrid = np.linspace(0,aMax,aPts) # range of values of assets for the plot

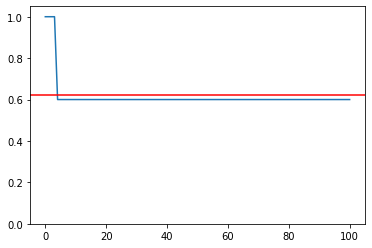

plt.plot(eevalgrid, pcct.solution[0].RiskyShareFunc[0][0](eevalgrid))

plt.axhline(pcct.MertSamCampVicShare, c='r') # The Campbell-Viceira approximation

plt.ylim(0,1.05)

plt.text((aMax-aMin)/4,0.45,r'$\uparrow $ limit as $m \uparrow \infty$',fontsize = 22,fontweight='bold')

plt.show()

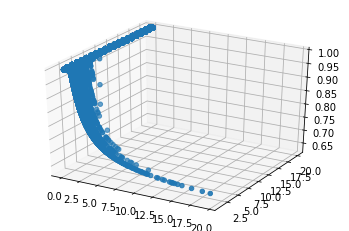

[4]:

# Simulate 20 years of behavior for a set of consumers

SimPer = 20

pcct.track_vars = ['aNrmNow', 't_age', 'RiskyShareNow']

pcct.T_sim = SimPer

pcct.initializeSim()

pcct.simulate()

pcct.RiskyShareNow_hist

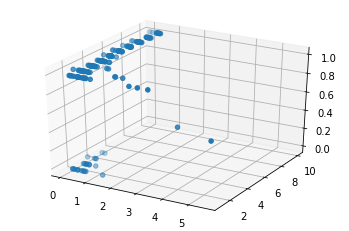

from mpl_toolkits.mplot3d import Axes3D

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

ax.set_zlim(pcct.MertSamCampVicShare,1.0)

ax.scatter(pcct.aNrmNow_hist, pcct.t_age_hist, pcct.RiskyShareNow_hist)

plt.show()

# The consumers are very impatient and so even if they start rich they end up as buffer stock savers

# But with all of their buffer stock savings in the stock market

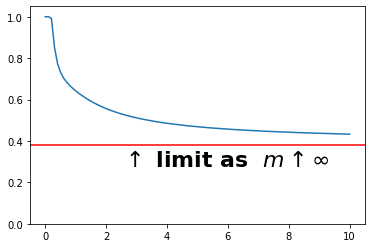

[5]:

# Solve the specialized / simple version for which there is a good approximation

# This is the version for which Campbell and Viceira provide an approximate formula

# assuming log normally distributed shocks

init_lognormportfolio = copy.deepcopy(init_portfolio) # Use same parameter values

init_lognormportfolio['RiskyAvg'] = Avg

init_lognormportfolio['RiskyStd'] = Std

init_lognormportfolio['RiskyCount'] = 11 # Eleven is enough points to do justice to the distribution

lnpcct = cpm.LogNormalPortfolioConsumerType(**init_lognormportfolio)

lnpcct.solve()

lnpcct.MertSamCampVicShare = lnpcct.RiskyShareLimitFunc(RiskyDstnFunc(init_portfolio['RiskyCount']))

plt.plot(eevalgrid, lnpcct.solution[0].RiskyShareFunc[0][0](eevalgrid))

plt.axhline(lnpcct.MertSamCampVicShare, c='r')

plt.ylim(0,1.05)

plt.text((aMax-aMin)/4,lnpcct.MertSamCampVicShare-0.1,r'$\uparrow $ limit as $m \uparrow \infty$',fontsize = 22,fontweight='bold')

plt.show()

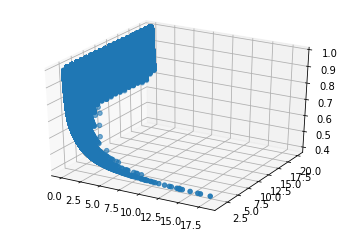

[6]:

# Again simulate a few periods

lnpcct.track_vars = ['aNrmNow', 't_age', 'RiskyShareNow']

lnpcct.T_sim = SimPer

lnpcct.initializeSim()

lnpcct.simulate()

lnpcct.RiskyShareNow_hist

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

ax.scatter(lnpcct.aNrmNow_hist, lnpcct.t_age_hist, lnpcct.RiskyShareNow_hist)

ax.set_zlim(lnpcct.MertSamCampVicShare,1.0)

plt.show()

[7]:

# Version where only discrete values of portfolio share of risky assets are allowed

init_portfolio_prb = copy.deepcopy(init_portfolio)

init_portfolio_prb['AdjustPrb'] = 1.0

init_portfolio_prb['PortfolioDomain'] = cpm.DiscreteDomain([0.0, 0.5, 0.6, 1.0])

pcct_prb = cpm.PortfolioConsumerType(**init_portfolio_prb)

pcct_prb.solve()

eevalgrid = np.linspace(0,100,100)

plt.plot(eevalgrid, pcct_prb.solution[0].RiskyShareFunc[0][0](eevalgrid))

plt.axhline(pcct_prb.RiskyShareLimitFunc(RiskyDstnFunc(init_portfolio['RiskyCount'])), c='r')

plt.ylim(0,1.05)

plt.show()

[8]:

# Version where you can choose your portfolio share only with some 0 < p < 1

init_portfolio_prb = copy.deepcopy(init_portfolio)

init_portfolio_prb['AdjustPrb'] = 0.5

init_portfolio_prb['PortfolioDomain'] = cpm.DiscreteDomain([0.0, 0.6, 1.0])

pcct_prb = cpm.PortfolioConsumerType(**init_portfolio_prb)

pcct_prb.solve()

plt.plot(eevalgrid, pcct_prb.solution[0].RiskyShareFunc[0][0](eevalgrid))

plt.show()

pcct_prb.track_vars = ['aNrmNow', 't_age', 'RiskyShareNow', 'CantAdjust']

pcct_prb.T_sim = 10

pcct_prb.AgentCount = 30

pcct_prb.initializeSim()

pcct_prb.simulate()

pcct_prb.RiskyShareNow_hist

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

ax.scatter(pcct_prb.aNrmNow_hist, pcct_prb.t_age_hist, pcct_prb.RiskyShareNow_hist)

plt.show()

[ ]: